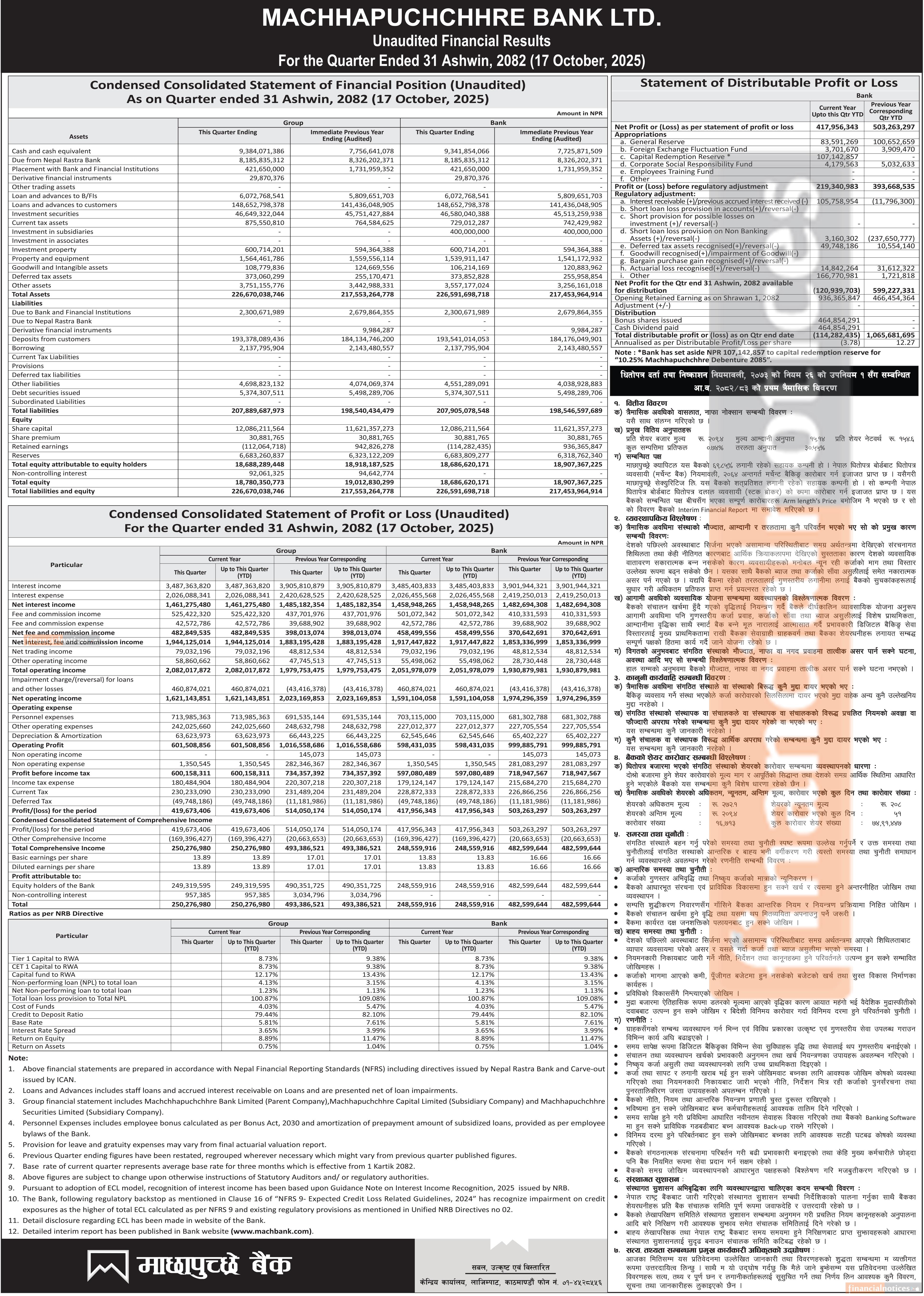

Machhapuchchhre Bank Limited (MBL) has released its unaudited financial statement for the first quarter of the fiscal year 2082/83. The report shows that both the bank’s net profit and earnings per share (EPS) have declined compared to the same period last fiscal year.

During the first three months of the current fiscal year, the bank earned a net profit of NPR 417.9 million, a 16.95% decrease from NPR 503.2 million in the corresponding period last year.

The decline in net interest income and an increase in impairment charges contributed to the drop in profit. During the review period, net interest income decreased by 1.60%, while fee and commission income rose by 23.70%. Similarly, total operating income increased by 6.27%, but operating profit dropped by 40.15%. The bank’s impairment charge rose to NPR 460.8 million, resulting in a decline in both net and operating profit. As a result, the bank’s distributable profit stood at a negative NPR 114.2 million.

Along with profit, the bank’s earnings per share (EPS) also decreased, dropping by NPR 2.83 to NPR 13.83. As of the end of Ashoj, the bank’s net worth per share was NPR 154.60, and its price-to-earnings (P/E) ratio stood at 15.14 times.

Machhapuchchhre Bank has a paid-up capital of NPR 12.08 billion and reserves totaling NPR 6.57 billion. As of the end of the first quarter, the bank had collected deposits worth NPR 193 billion and disbursed loans totaling NPR 148 billion.

Published by Machhapuchhre Bank on 2082-7-21

View More by Machhapuchhre Bank