Nepal's Macroeconomic and Financial Landscape for September 2023 Revealed by Nepal Rastra Bank

Kathmandu, Nepal - October 17, 2023

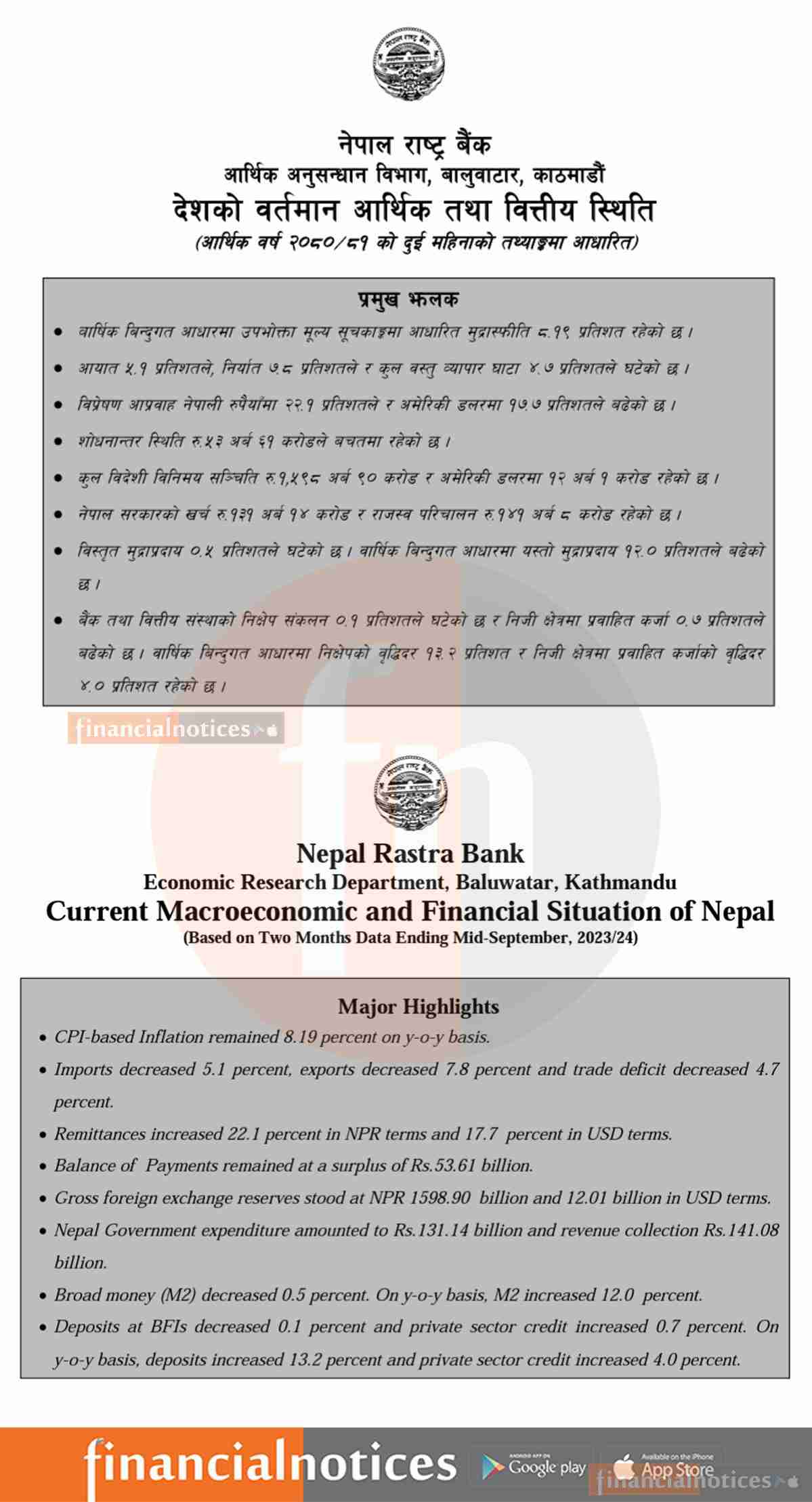

Here are the major highlights of the report:

1. Inflation Remains Steady: Consumer Price Index (CPI)-based inflation has remained relatively stable, registering at 8.19 percent on a year-on-year basis. This consistency in inflation rates suggests a measure of price stability within the country.

2. Trade Balance Sees Improvement: Nepal witnessed a decline of 5.1 percent in imports and a 7.8 percent reduction in exports, leading to a 4.7 percent decrease in the trade deficit. These figures indicate an encouraging trend in Nepal's trade balance, which may contribute to a more stable economic environment.

3. Remittances Surge: One of the standout features of the report is the significant increase in remittances. Remittances increased by a substantial 22.1 percent in Nepalese Rupee (NPR) terms and 17.7 percent in United States Dollar (USD) terms. This surge in remittances is likely to have positive implications for household incomes and the overall economy.

4. Balance of Payments Remains Surplus: Nepal continues to maintain a healthy balance of payments surplus, standing at Rs. 53.61 billion. This surplus indicates that the country's international transactions and trade are in good standing.

5. Robust Foreign Exchange Reserves: Gross foreign exchange reserves are reported at NPR 1598.90 billion, equivalent to approximately USD 12.01 billion. This strong reserve position provides a cushion against external economic shocks and helps stabilize the country's currency.

6. Government Fiscal Performance: The Nepal Government's expenditure for the period amounted to Rs. 131.14 billion, while revenue collection reached Rs. 141.08 billion. This indicates a higher revenue collection than expenditure, potentially contributing to prudent fiscal management.

7. Money Supply and Credit Growth: The report highlights that broad money (M2) experienced a slight decrease of 0.5 percent. However, on a year-on-year basis, M2 showed healthy growth, increasing by 12.0 percent. Deposits at financial institutions decreased marginally by 0.1 percent, but private sector credit increased by 0.7 percent during the period. On a year-on-year basis, deposits increased by 13.2 percent, while private sector credit increased by 4.0 percent.

The findings of the Nepal Rastra Bank's report provide valuable insights into the nation's economic stability and growth prospects. While challenges remain, including the need for sustained efforts to boost exports and manage inflation, the overall outlook appears promising with a robust balance of payments, remittance growth, and sound fiscal management. These factors are expected to support Nepal's economic resilience in the coming months.

Published by Nepal Rastra Bank on 2080-6-30

View More by Nepal Rastra Bank